The Home Buying Process

Before You Buy

Preparation is key when purchasing a property. From down payments and mortgage prequalification to understanding the type of home that will meet your needs and satisfy your wants, I can make sure your financial ducks are in a row and your expectations are grounded in reality when preparing to buy.

The Search

Selecting your perfect home will require research, expert guidance and knowledge of the local market, and you'll need to consider what it is you're looking for. I can help you find the place that fits your taste, your budget, and your lifestyle. I'm a home hunter's best friend.

Making the Purchase

So, you've found the perfect home that meets all your criteria, from a great location to just the right square footage. As your trusted agent, I will guide you through the logistical — and emotional — challenges of the purchase process, to ensure you are in a solid position before you sign on the dotted line.

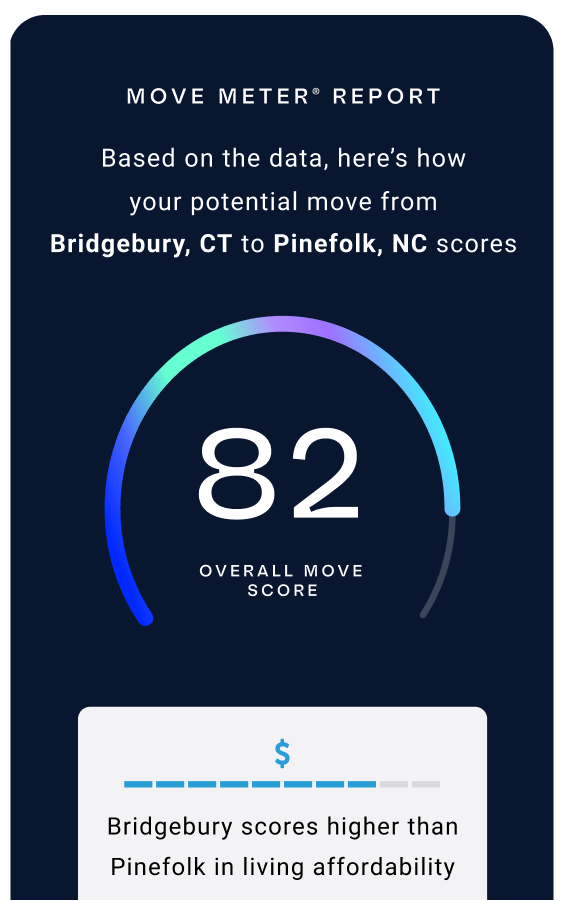

Find Out What You Can Afford

Click the button below to access a helpful loan calculator — just the tool you need to get a general idea of your home search budget. When the time is right, I can connect you with a trusted lender to begin the preapproval process — a critical first step toward making a smart, solid offer on your dream home.

Here's a ten-step outline of bying your next home.

- Determine your budget: Determine how much you can afford to spend on a house by calculating your income, expenses, and debts. You can use online calculators to help you figure out how much house you can afford.

- Save for a down payment: Save for a down payment on your new home. This can range from 3% to 20% of the home's purchase price. The larger your down payment, the lower your monthly mortgage payment will be.

- Get pre-approved for a mortgage: Get pre-approved for a mortgage from a lender. This will give you an idea of how much you can borrow and the interest rate you qualify for.

- Find a real estate agent: Find a real estate agent who specializes in the area you want to buy a home. They will help you find homes that meet your criteria and negotiate the best deal for you.

- Start house hunting: Start house hunting with your real estate agent. Visit homes that fit your budget and needs.

- Make an offer: When you find a home you love, make an offer. Your real estate agent will help you draft an offer that is fair and reasonable.

- Get a home inspection: Once your offer is accepted, get a home inspection. This will help identify any issues with the home before you close on the sale.

- Secure financing: Secure financing from your lender. They will verify your income and employment status and finalize the terms of your mortgage.

- Close on the sale: Close on the sale of your new home. You will sign a lot of paperwork, but your real estate agent and lender will help guide you through the process.

- Move in: Once the sale is closed, it's time to move in! Settle in and enjoy your new home.

Remember that buying a home is a big decision and requires a lot of planning and research. Don't rush into anything and make sure you are comfortable with the home and the financial commitment before you sign on the dotted line.